amazon flex quarterly taxes

How much will I owe at tax time. If youre looking for a place to discuss DSP topics head over to ramazondspdrivers.

How Many Packages Does Amazon Flex Give You

Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on.

. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. When do I need to pay quarterly taxes if I started driving for Amazon Flex this year. Income taxes can be defined as the total amount of income tax expense for the given period.

You may also need to. We are actively recruiting in. You expect to owe at least 1000 in tax for the current tax year after subtracting your withholding and credits.

This is your business income on which you owe taxes. You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. The easiest way to pay federal quarterly business taxes is to e-file using IRS Direct Pay.

Amazon Flex is a service that offers rideshare drivers to make extra money on the side by handling grocery orders from PrimeNow Amazon Fresh and Whole Foods. If you have a lot more 1099 side work you can add to your estimated quarterly due. The front page of the internet.

Amazon annualquarterly income taxes history and growth rate from 2010 to 2021. If youve determined that youre on the hook for quarterly taxes this year you have a couple of ways to pay your federal quarterly taxes. You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply.

The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes. If you earn at 600 per tax year driving for Amazon Flex expect a 1099-NEC form in the mail from them by late Januaryearly February of the following year. Those payments are generally due on April 15 June 15 September 15 and January 15 of the following tax year or the next business day due to a.

How much should I set aside for taxes. When you sign up as a driver for Lyft DoorDash or Amazon Flex you need to fill out a W-9 form which provides the company with your information so that they can issue you a 1099. Understand that this has nothing to do with whether you take the standard deduction.

You can plan your week by reserving blocks in advance or picking them each day based on your availability. Amazon income taxes for the quarter ending December 31 2021 were 0612B a 813 increase year-over-year. Because working for Amazon Flex makes you an independent contractor youll be responsible for withholding money for your taxes.

Individuals C corporations sole proprietors single-member LLCs or LLCs taxed as corporations are required to file taxes by. Quarterly Tax Calculator Try it. Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments.

Increase Your Earnings. Keep in mind that Amazon does not withhold or deduct taxes from you submitting quarterly estimated taxes and annual income tax is ultimately your responsibility as an independent contractor. Gig Economy Masters Course.

Just claim the 1099 next year. Driving for Amazon flex can be a good way to earn supplemental income. Amazon Flex quartly tax payments.

Choose the blocks that fit your schedule then get back to living your life. How to pay quarterly taxes. I did flex full time in 2017 made about 30k and after deductions Ill owe around 27k.

You expect your withholding and credits to be less than the smaller of. In your example you made 10000 on your 1099 and drove 10000 miles. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program.

With Amazon Flex you work only when you want to. If you expect to owe taxes of 1000 or more youre usually required to make quarterly estimated tax payments. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and.

In case you are wondering why you have not heard of Amazon Flex before it is only because it is the least spoken about delivery programs. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. You went through the process of applying to be an Amazon Flex driver passing your background check submitting your drivers license information and setting up your direct deposit so its likely that youre eager to earn more money.

This form will have you adjust your 1099 income for the number of miles driven. With only Flex amount stated youll be well below that number. Businesses such as partnerships S corporations or LLCs that are taxed as partnerships are required to file taxes by March 15 2022.

Youre suppose to pay quarterly which I will now dropping 27k nearly all at once will mess up my cash flow. Knowing your tax write offs can be a good way to keep that income in your pocket. Once your direct deposit is on its way Amazon Flex will send you an email to let you know.

When most people get into a gig economy job like this they hope to make much more money than that. How Much To Put Away For Quarterly Taxes. So if you want to.

Louis MO Boston MA Cincinnati OH Salt Lake City UT. If youre an Amazon seller living in the US then youre probably aware that tax time is coming up.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Tax Guide For Self Employed Amazon Flex Drivers Goselfemployed Co

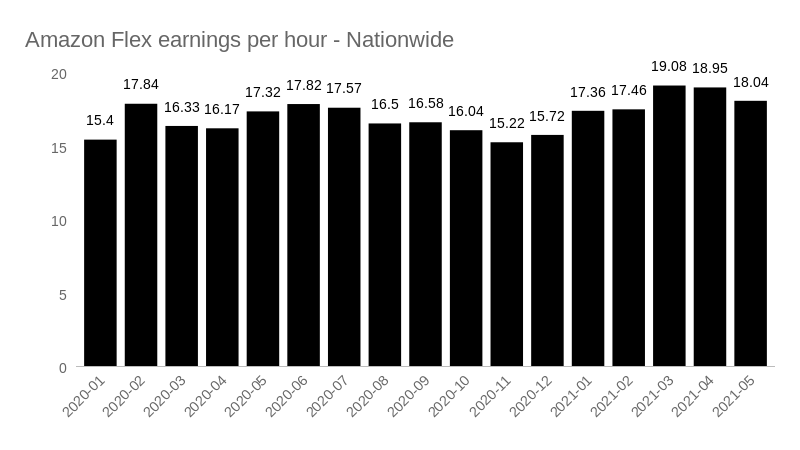

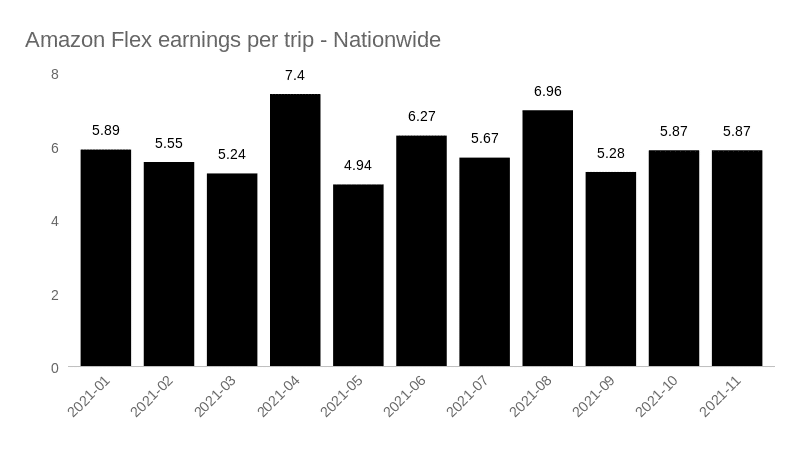

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

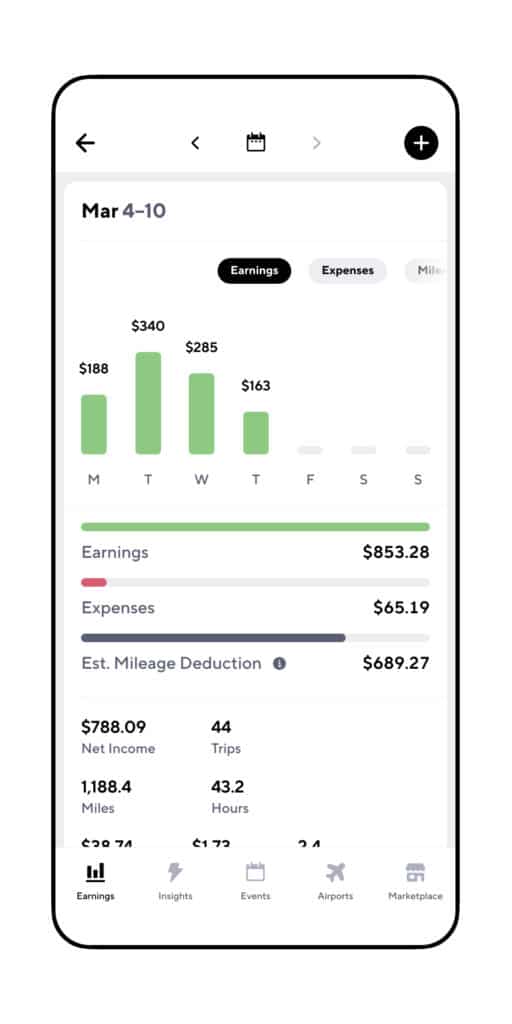

How Much Do Amazon Flex Drivers Make Gridwise

![]()

How Quickly Do I Get Paid Through Amazon Flex Money Pixels

How Amazon Build One Day Shipping Digital Laoban

How To Do Taxes For Amazon Flex Youtube

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

How To File Amazon Flex 1099 Taxes The Easy Way

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How Much Do Amazon Flex Drivers Make Gridwise

How Much Do Amazon Flex Drivers Make Gridwise

How Amazon Build One Day Shipping Digital Laoban

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels